Wave Analysis 14.09.2012 (EUR/USD, GBP/USD, USD/CHF, USD/JPY)

14.09.2012 / 10:57

Analysis for September 14th, 2012

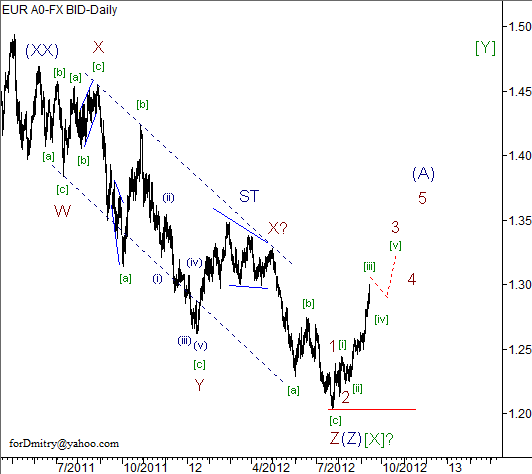

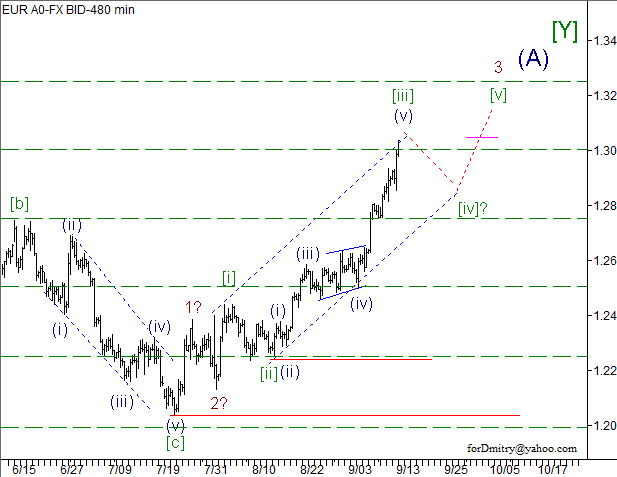

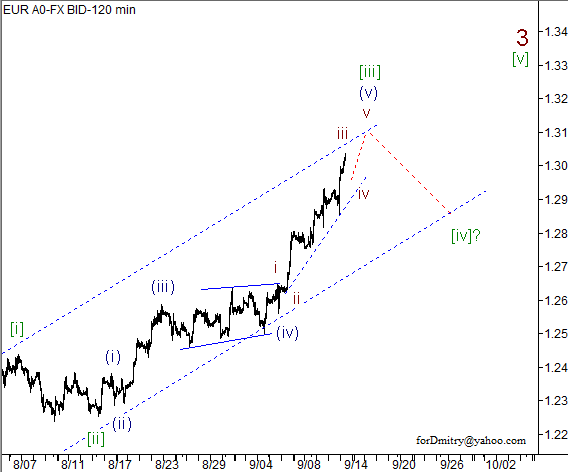

EUR/USD

In general, the situation hasn’t changed much, we may assume that at the moment Euro is moving inside a new ascending trend, (double) zigzag [Y].

We may assume that the price is forming an ascending wave (A) of [Y], the current structure of which may be used for trading.

We can’t exclude a possibility that Euro is finishing an ascending impulse [iii] of 3. Later, we can expect a descending correction [iv] of 3.

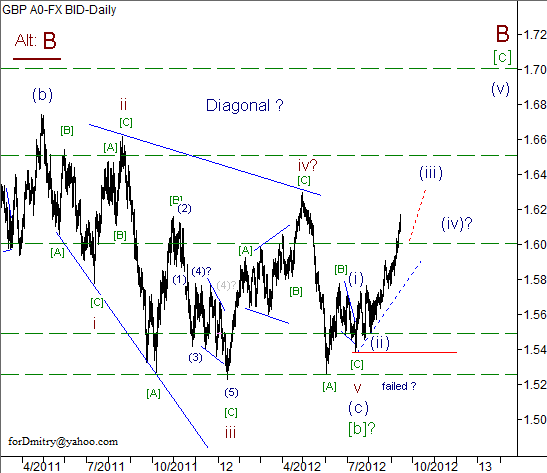

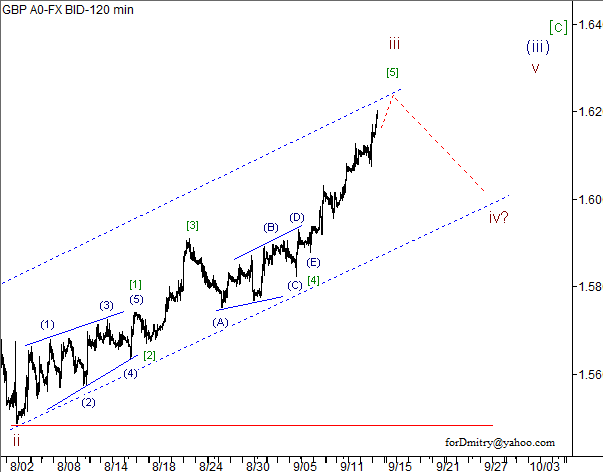

GBP/USD

The mid-term forecast hasn’t changed much, we may assume that Pound is forming an ascending wave [с] of B.

We may assume that the price is forming an ascending wave [c], the current structure of which may used for trading.

We can’t exclude a possibility that Pound is finishing an ascending impulse iii of (iii) of [c]. Later, we can expect a descending correction iv of (iii) of [c].

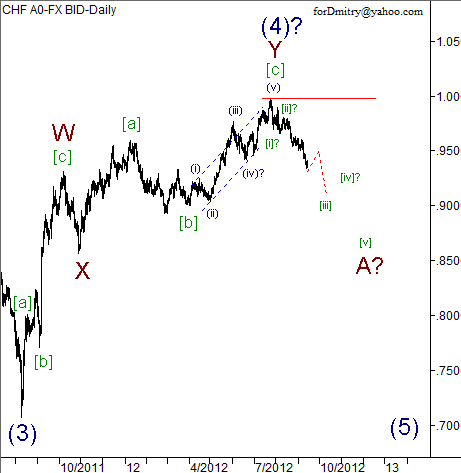

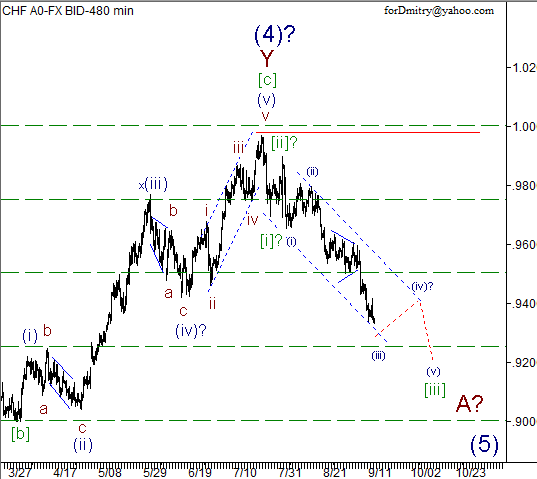

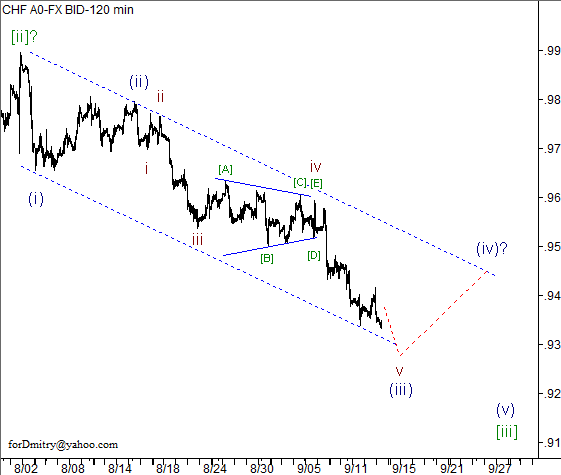

USD/CHF

In general, the situation hasn’t changed much, we may assume that the price is now forming a final descending wave (5), unless Swiss National Bank interferes.

We may assume that the price has is forming a descending wave (5). The current structure of which may used for trading.

We can’t exclude a possibility that Franc is finishing a descending impulse (iii) of [iii] of A, Later, we can expect an ascending correction (iv) of [iii] of A.

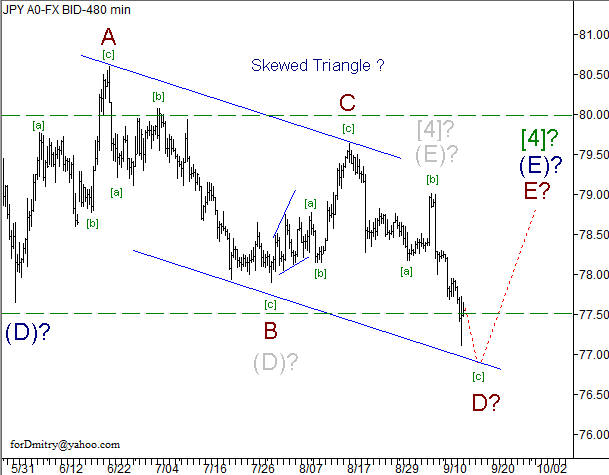

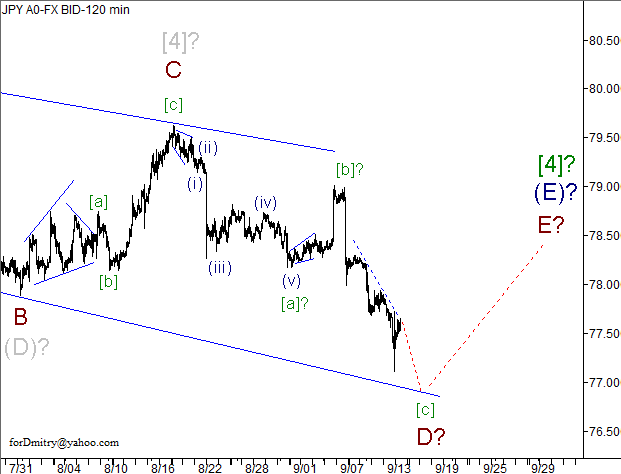

USD/JPY

A chart structure implies that the price may complete a large and long horizontal correction [4] of V within the next several days.

We can’t exclude a possibility that that a long horizontal correction [4] may be completed with skewed triangle (E) of [4].

It looks like the price is completing wave D of (E) of [4], we can expect a final wave E of (E) of [4] of skewed triangle (E) of [4] and of horizontal triangle [4].

ليست هناك تعليقات:

إرسال تعليق