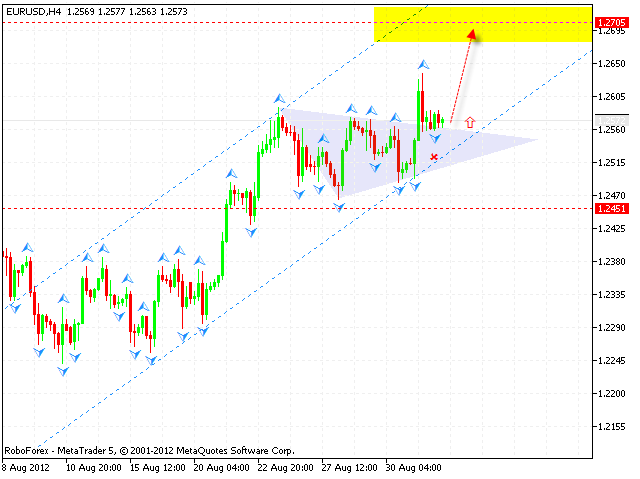

EUR/USD

The EUR/USD currency pair continues moving inside the ascending channel, the price has already broken the upper border of “triangle” pattern. We should expect Euro to start growing up from the current levels. One can consider buying the pair with the tight stop below 1.2560. The final target of the growth is the area of 1.2705. We recommend to increase the amount of long positions only after the price breaks the level of 1.2650. If the price falls down lower than 1.2515, this scenario will be cancelled.

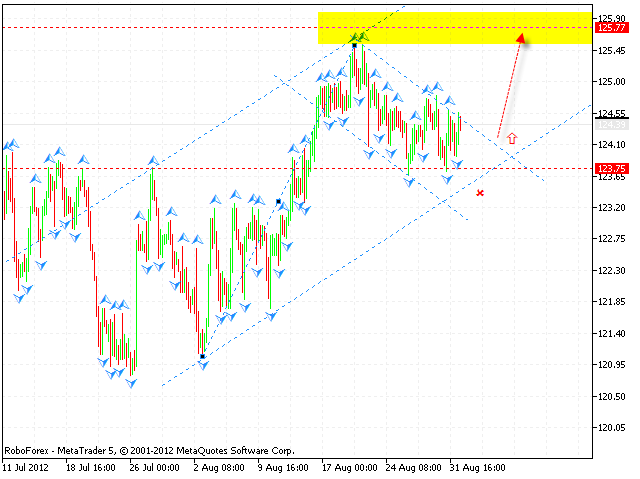

GBP/JPY

The GBP/JPY currency pair is moving inside the ascending pattern. One can consider buying the pair after the price leaves the descending channel. The target of the growth is the area of 125.77. If the price falls down lower than 123.65, this scenario will be cancelled.

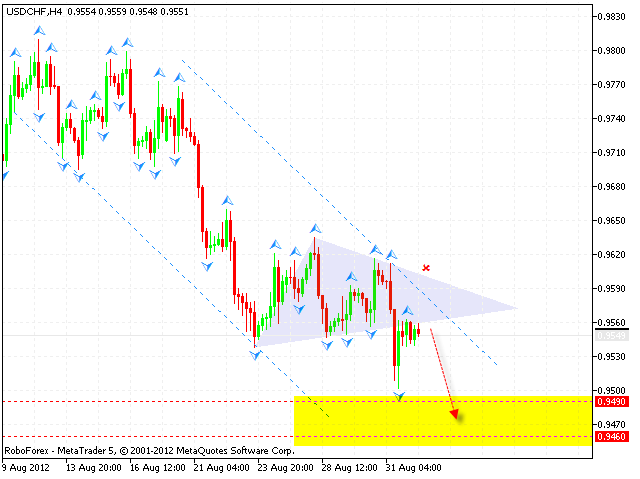

USD/CHF

The USD/CHF currency pair continues moving inside the descending channel, the structure of the price movement is similar to that of Euro. The target of the fall is the area of 0.9490 - 0.9460, one can consider selling Franc form the current levels with the tight stop. If the price grows up higher than 0.9590, this scenario will be cancelled. We recommend to increase the amount of short positions only after the price breaks the level of 0.95.

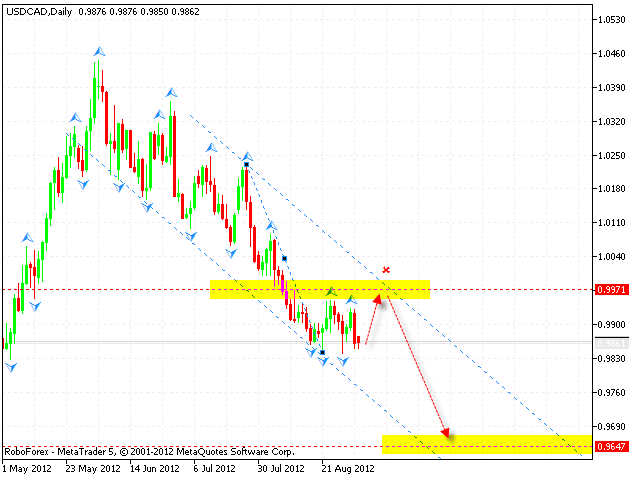

USD/CAD

Canadian Dollar continues moving inside the descending trend. The pair is expected to be corrected towards the channel’s upper border, where one can consider selling it with the tight stop. The target of the fall is the area of 0.9645. We recommend to increase the amount of short positions only after the price breaks the level of 0.9830. If the price grows up higher than 1.0030, this scenario will be cancelled.

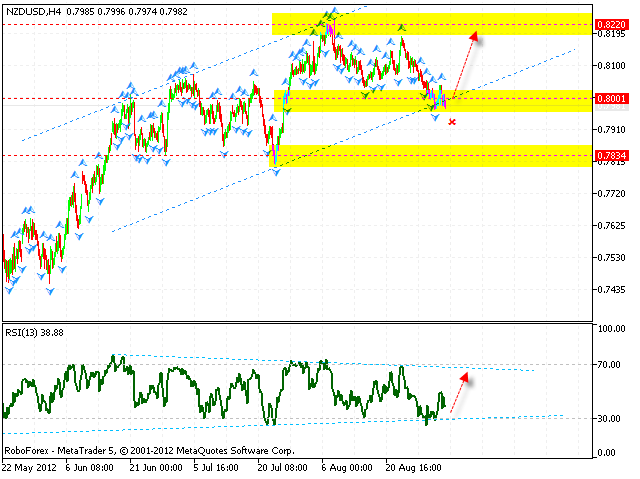

NZD/USD

New Zealand Dollar is moving according to the forecast, the price is testing the ascending channel’s lower border. The RSI indicator is still testing the channel’s lower border. The price is expected to start moving upwards from the current levels. One can consider buying the pair with the tight stop, the target of the growth is the area of 0.8220.

ليست هناك تعليقات:

إرسال تعليق