Wave Analysis 07.09.2012 (EUR/USD, GBP/USD, USD/CHF, USD/JPY)

07.09.2012 / 09:35

Analysis for September 7th, 2012

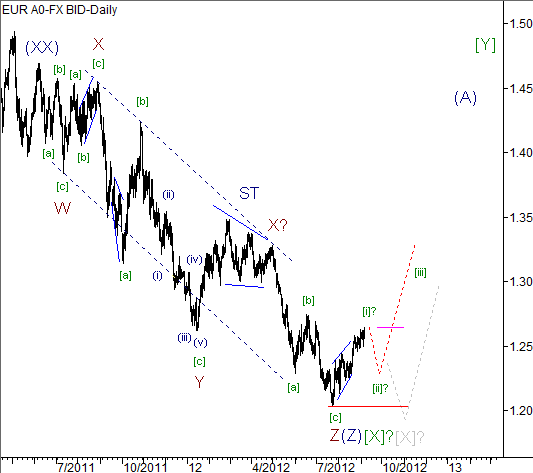

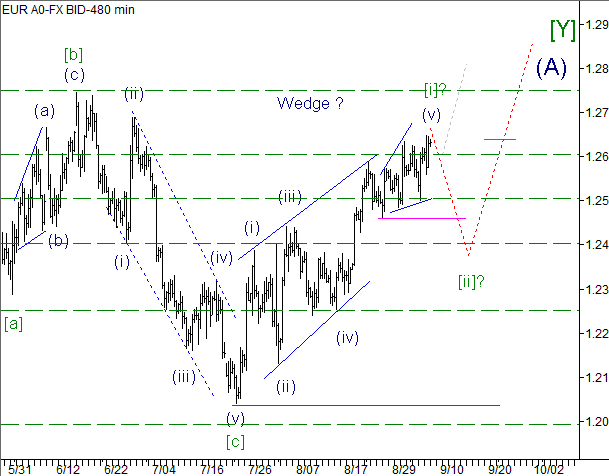

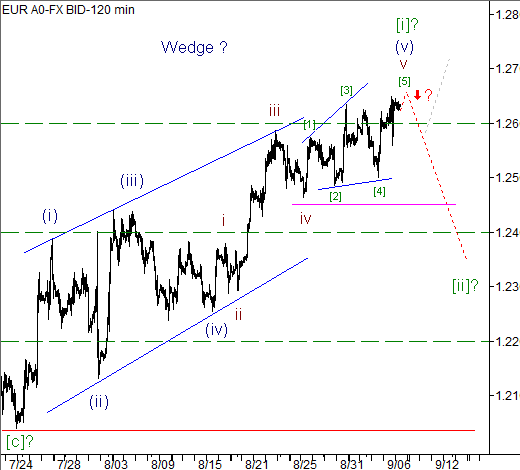

EUR/USD

We may assume that the pair has finished a large correction [X] and at the moment the price is moving inside a new ascending trend, (double) zigzag [Y].

One of the possible scenarios implies that the price is finishing an ascending wedge (i) and we can expect a descending correction (ii).

It looks like Euro is finishing an ascending wedge (i) with diagonal triangle v of (v) of [i]. We can expect a descending correction [ii]. If the assumption is correct, one can consider opening short positions.

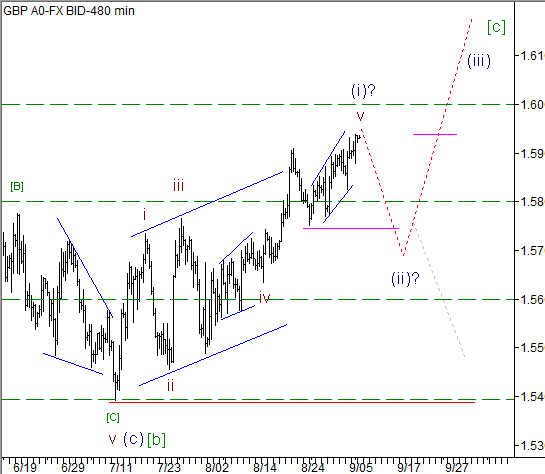

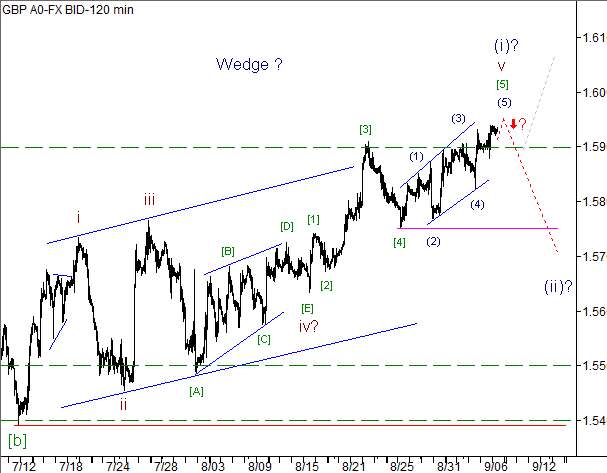

GBP/USD

We may assume that an ascending wave [с] of B started with wedge (i) of [c] of B.

One of the possible scenarios implies that the price is finishing an ascending wedge (i) and we can expect a descending correction (ii) of [c].

It looks like Pound is finishing an ascending wedge (i) with diagonal triangle [5] of v of (i). We can expect a descending correction (ii). If the assumption is correct, one can consider opening short positions.

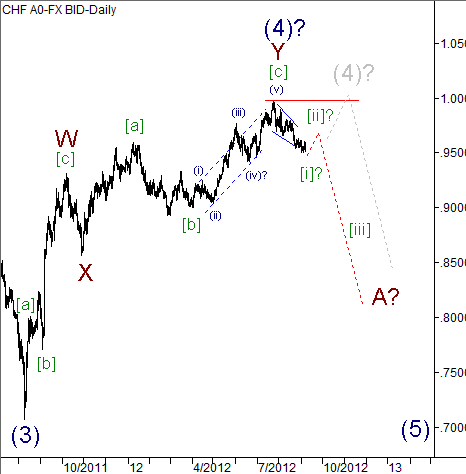

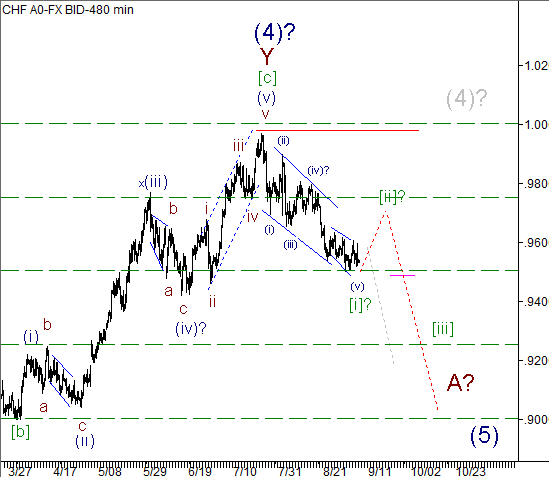

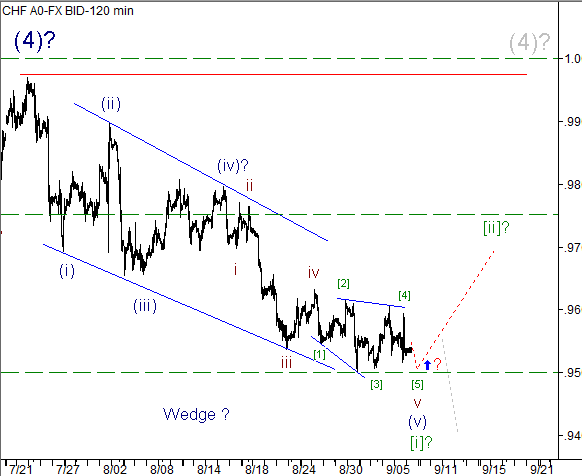

USD/CHF

We may assume that the price has completed double zigzag (4), and started forming a final descending wave(5).

Another possible scenario implies that the price is finishing a descending wedge [i]. We can expect an ascending correction [ii].

It looks like the price is completing a descending wedge [i] with diagonal triangle v of (v) of [i]. We can expect an ascending correction [ii]. If the assumption is correct, one can consider opening long positions.

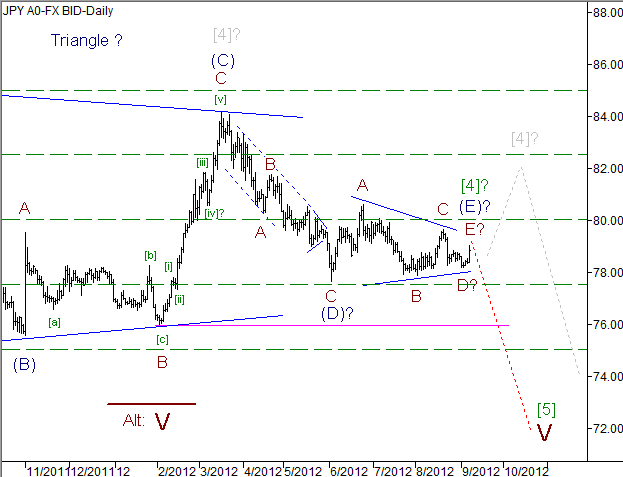

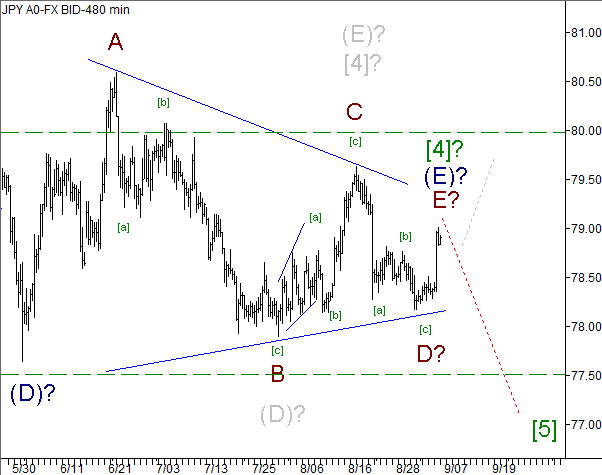

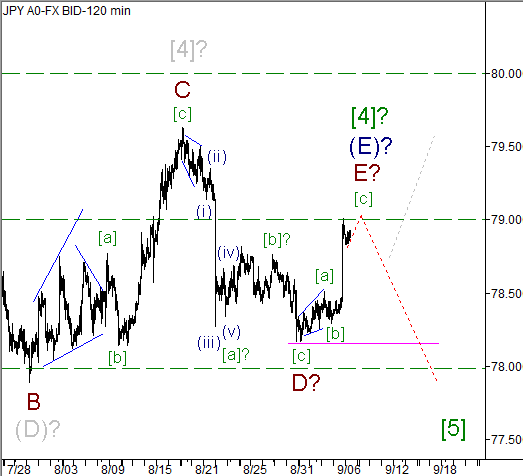

USD/JPY

The fact that the price is moving inside a narrow range implies that the pair is probably finishing a large and long horizontal correction [4] of V.

We may assume that a long horizontal correction [4] may be completed with horizontal triangle (E) of [4].

It looks like the price is completing a final wave (E) of [4] of triangle [4], also in the form of triangle. If it’s true, then it’s quite logical to expect the price to fall down and form a descending wave [5].

ليست هناك تعليقات:

إرسال تعليق