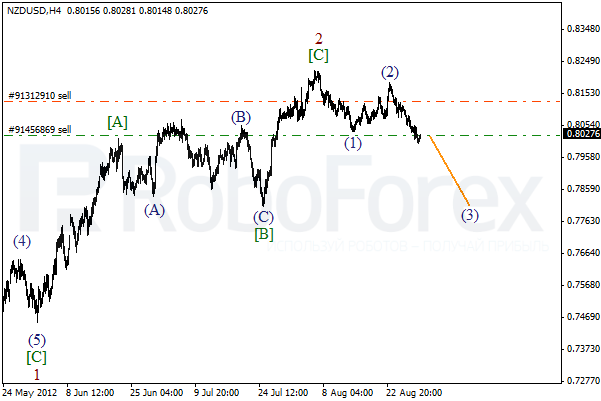

THE TAKEAWAY: [U.S. consumer confidence rose in August to highest level in three months] > [Adds to signs of improving U.S. economy] > [USD strengthens]

Consumer confidence in the U.S. rose more than expected in August to the highest level in three months, adding to signs that the U.S. economy is picking up. Final monthly readings indicated that the Thomson Reuters / University of Michigan Confidence Index (MCSI) climbed to 74.3 in August from its preliminary print of 73.6 and July’s reading of 72.3. The median forecast of 60 economists surveyed by Bloomberg News called for a final print of 73.6.

Recent economic data has shown improvements in job growth and home prices, boosting consumer sentiment and the likelihood of a pickup in household spending in coming months. On the other hand, rising fuel prices and concerns over impending tax changes may be holding back larger gains in consumer confidence.

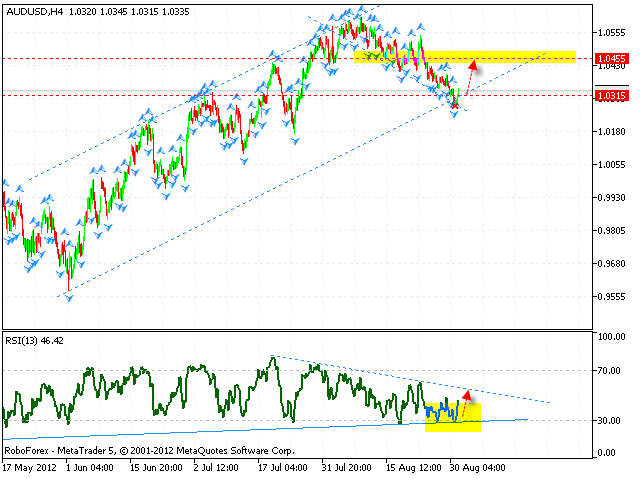

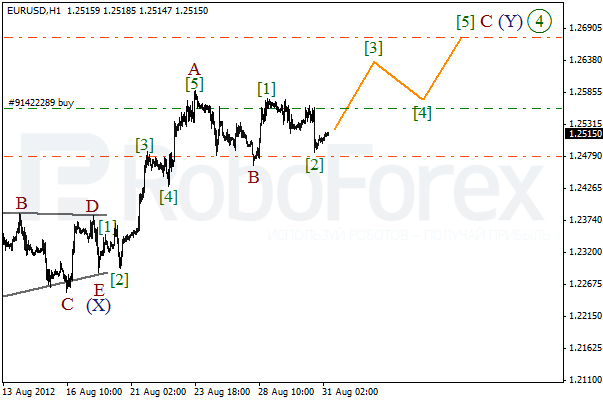

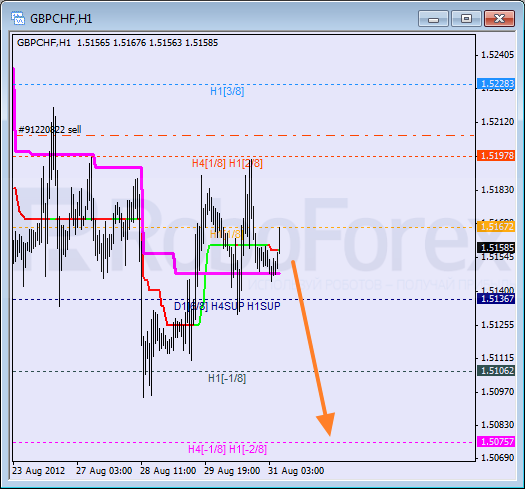

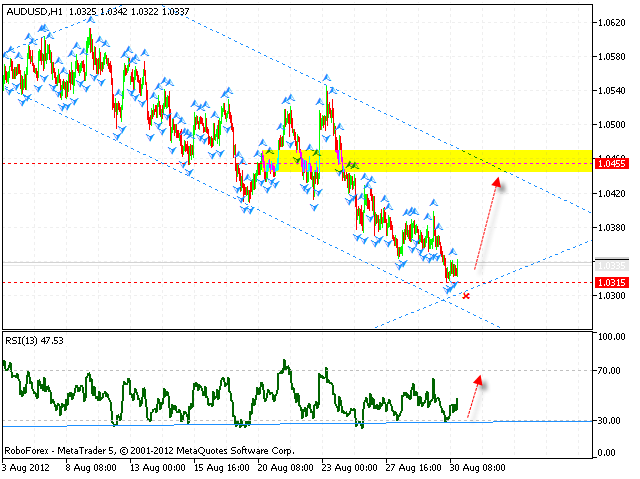

AUDUSD 1-minute Chart: August 31, 2012

Chart created using Market Scope – Prepared by Tzu-Wen Chen

In the minutes following data release, the U.S. dollar strengthened against the Australian dollar, rising to a high of $1.0279. The subsequent reversal came after Federal Reserve Chairman Ben Bernanke’s comments on the U.S. economic outlook, ahead of today’s Jackson Hole Economic Policy Policy Symposium.